I once had a boss who would proclaim “Das greenback ist kaputt!” in a faux German accent as we watched the dollar trade down. He was kidding, but today some believe that to be true. They think the dollar (USD) is going to lose its reserve status. Not that this is new. Since the financial crisis, doom-mongers have peddled the idea that the Federal Reserve’s treasury and mortgage backed bond purchases would lead to hyperinflation and the death of the dollar. Cassandra had the misfortune of making true predictions that were never heeded. The doom-mongers have the opposite problem, false predictions broadcast ad nauseam.

The new argument driving demise of the dollar stories is that the sanctions being imposed on Russia will undermine dollar reserve status. The US and its allies can impose their wills on countries that displease them by limiting access to the global financial system. Russia, China, Iran and a few others would love an alternative system. Hope springs eternal.

If the dollar is on the verge of losing its reserve status, surely it must be plunging. Nope. It’s just fine, thanks for asking. Its broad exchange rate, weighted by trade shares with each nation and adjusted for inflation, is near the top of its range, in rude health, as the Brits would say.

OK, what makes for reserve status? Here are a few things:

Transactions demand: Is the currency used extensively to price and execute international transactions?

Precautionary demand: Is the currency used to hold reserve balances against future needs?

Capital markets use: Is the currency used by countries and companies to issue debt?

The USD punches above its weight in transactions demand. It is used to invoice the majority of exports in every region except Europe. That has not changed much in the last twenty years. It leads in payments, both for physical goods and in financial transactions. The EUR is second. The Chinese renminbi (CNY) is a distant fifth, with a 2.3% share.

The USD is by far the main currency held as reserves. This is changing, but at a measured pace. The USD reserve share came down from just over 70% in 1999 to around 60% in 2021. Sixty percent, still dominant in my book.

The USD is the main currency used by governments to issue external debt. Countries issue external debt for many reasons, building up external reserves and funding projects are among them. Dare I mention that you should do your due diligence if you invest in such projects? There was this one time when Mozambique wanted to buy a tuna fleet…

And that leads to the reason 80% of sovereign bonds and over 60% of foreign corporate bonds are issued in USD. The USD has the deepest and most liquid capital markets and is governed by the rule of law. The vast majority of such bonds are issued under New York or British law. That is a key protection for the bondholders. Countries like China and Russia do not operate rules based systems. Suddenly turning the tutoring sector into non-profit businesses, arranging for companies to be sold to favored actors on flimsy pretenses or using trade restrictions because a country lets Taiwan open an office or calls for an investigation into the origins of Covid doesn’t happen in the US or in the bulk of reserve issuing countries.

Back to the demise of the dollar. It is strong. It has a large share of international goods transactions. It is relatively stable versus most other currencies. Central banks hold sixty percent of their FX reserves in it. Countries issue over eighty percent of their non-domestic debt in USD. Many of these things are self reinforcing. Much as with the use of Google for search, the dollar benefits from network effects.

Could those things change on the margin? Of course they can. Just as you use different social networks for different purposes, e.g., Facebook versus LinkedIn, you might use different currencies for different regions. Europe mostly uses EUR for invoicing; it would be unsurprising to see intra-Asian trade move more towards CNY.

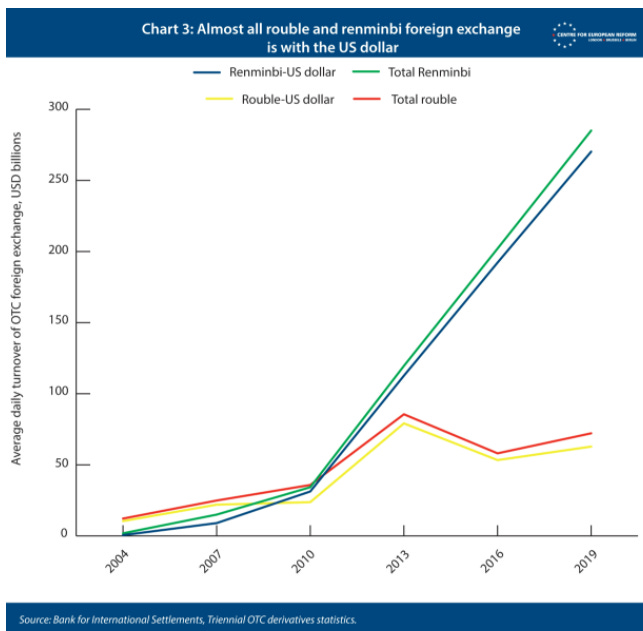

Sanctions could accelerate use of the CNY. China is a dominant trader and, as such, might be able to impose CNY invoicing in some cases. Still, it will take time. Despite China’s weight in world trade, the CNY currently has a low share of global transactions and trade invoicing. Its currency is also difficult to transact in other than against the USD.

Increased use of a currency often depends upon the openness of its financial markets and whether they are governed by the rule of law. China values control over openness. The renminbi’s reserve use will grow, but it is unlikely to become dominant without open, rules based financial markets.

The high USD reserve share post WWII has come down and is likely to come down further. It was a result of capital controls imposed by many countries during their post-war reconstruction. A diverse set of reserve currencies is not new. In 1913, it’s estimated that central banks held about 50% British pounds, 33% French francs and 17% German marks. In the interwar period, it is believed that the dollar replaced the mark in that mix.

More currencies have become liquid. More capital markets have opened up since the late 1980s. Those are the currencies being used for reserve diversification. Ten percent of reserve holdings are now in currencies that were not in the mix twenty years ago. CNY, at 2.5%, is likely there due to goods trade. The Australian dollar, 2%, and the Canadian dollar at 2.3% are there due to reasonably liquid financial markets and the diversification they provide.

Could sanctions on Russia change the narrative? No. The international monetary system is rules based. Russia would love to change the rules, but it has no power to do so. Russia and the rouble barely register in international trade and are effectively non-existent in capital markets.

The existing global reserve system emerged after the Bretton Woods system broke down in the early 1970s. It may be guided by the US and its allies, but it is not really run by a central authority. It will continue to evolve, likely in ways neither you nor I will anticipate, but the USD will remain at its center for a long while to come.

Nothing lasts forever. The USD will lose its reserve status…someday. That day is not today, nor will it be tomorrow or the day after that.