I am not a geopolitical analyst and I have not become one since Russia invaded Ukraine. I will not comment on Putin’s motivations or his endgame for Ukraine. There are people who are far more educated on those sorts of things than I am and yet, they are just as likely to be wrong as they are to be right. The best advice I can give for these situations is to wait and see how things play out. Do not do anything rash.

There is an observation about the intersection of geopolitics and markets that I would like to pass along. It has to do with markets and economics, as the bulk of what I write does. I am aware of the human tragedy that is occurring and do not seek to diminish it in any way by these comments.

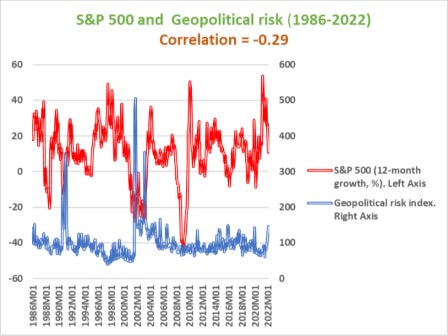

Geopolitical events like wars can have horrendous consequences in the regions where they happen, while having less effect than you might expect in the rest of the world. Below is a chart of S&P 500 correlation with geopolitical risk. The correlation is modest and negative. A negative sign makes sense since you would expect the market to fall in a crisis.

The effect of most geopolitical crises on US markets has been small. Pearl Harbor, the attack on US soil that sent us into WWII, induced a fall of 19.8% in US stocks, the largest drawdown in the list below. A 20% decline is considered a bear market. Even Pearl Harbor, an event that drew the US into a world war, did not induce a bear market in stocks. The market recovered in just under a year. The vast majority of geopolitical issues led to far smaller reactions than Pearl Harbor.

Despite the historical lack of correlation between markets and geopolitical events, this time they might become linked due to timing. I feel that if we do see an extended bear market, it will be due to existing conditions rather than the Russian invasion of Ukraine.

We have elevated inflation due to increased demand for goods, the inability to supply them, reopening economies, a labor shortage and surging energy prices. The Fed will have to tighten. The Ukraine tragedy might slow the tightening a bit, but will not stop it.

If higher energy prices result from the invasion, the peak in the funds rate could be higher than it would have been. While Russia’s assault might not have had a permanent effect in isolation, it is possible that it will worsen the situation we were already in.